Firms in the fast-growing ASEAN giant look to Hong Kong as a fund-raising platform

Indonesian companies could turn to Hong Kong as a fund-raising platform, drawn by the city’s global financial-hub status and strengths in finance, technology and other sectors which are growing rapidly in the archipelago.

Hong Kong Trade Development Council (HKTDC) Research, in association with CCB International, released a report detailing the attraction an HKEx listing or other forms of fund raising through Hong Kong offered to Indonesian firms.

Strong potential

Despite the Indonesia Stock Exchange (IDX) being a very active market – with strong initial public offering (IPO) momentum over the past few years and recent set up of the New Economic Board – just three Indonesian companies domiciled in Indonesia are currently listed overseas, none in Hong Kong.

A rough estimate using Refinitiv data suggests more than 70% of IDX-listed companies meet listing requirements for HKEx’s Growth Enterprise Market (GEM) and 25% for the Main Board.

With rapid economic development in Indonesia in recent decades, as well as further regional economic integration initiatives such as the Regional Comprehensive Economic Partnership (RCEP), Indonesian companies are stepping up their regional expansion. Investors from all around the world, particularly from Mainland China and Hong Kong, are also increasingly interested in investing in Indonesia and the Association of Southeast Asian Nations (ASEAN) as a whole.

Leading exchange

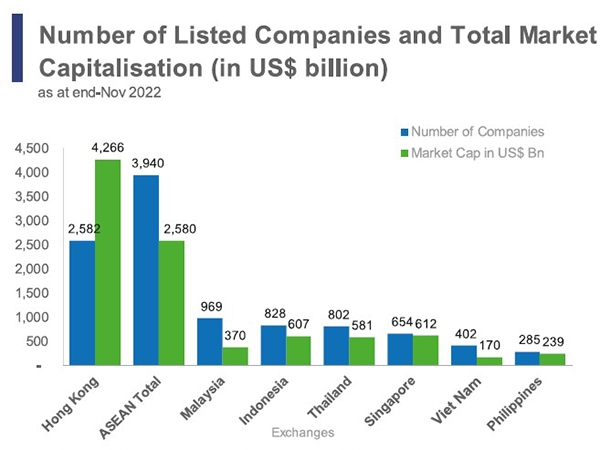

IDX is the second-largest stock exchange in ASEAN – both in terms of the number of listed companies (behind only the Bursa Malaysia) and total market capitalisation (on a par with the Singapore Exchange) – and hosts a vibrant IPO scene.

Source: World Federation of Exchanges, CEIC and the respective stock exchanges

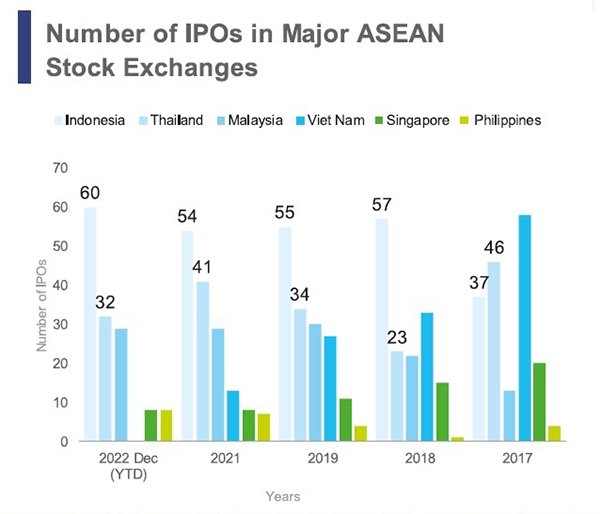

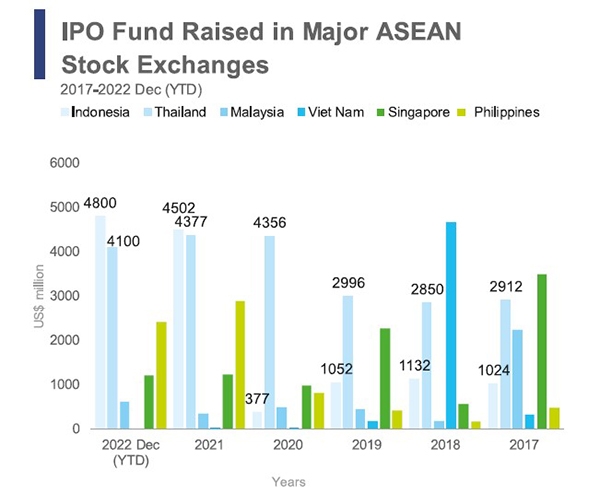

IPOs on IDX have exhibited strong momentum in the last few years and since 2018, the exchange has had the largest number of IPO deals among key ASEAN markets. In 2022, the amount of IPO funds raised on IDX led the field among ASEAN markets, highlighting Indonesian companies’ growing need for funds. Alongside the 2022 IPO of GoTo Group, Indonesian’s largest tech company, other prominent IPOs in recent years include those of Bukalapak and PT Dayamitra Telekomunikasi Tbk, both of which raised more than US$1.5bn in 2021. Between 2017 and last year, the average annual amount of funds raised reached US$2.1 billion, the second largest figure in ASEAN after that of Thailand.

Source: EY, Global IPO Trends 2022 for 2022 YTD data; Deloitte, Southeast Asia IPO Capital Market – 2021 full year report

Note: 2022 Dec (YTD) refers to the full calendar year and covers completed IPOs from 1 January 2022 to 5 December 2022, plus expected IPOs by 31 December 2022 (forecasted as of 5 December 2022).

Sources: EY analysis, Dealogic

Comparison between HKEX and IDX

HKEX leads IDX by far both in terms of market capitalisation and number of listed companies. At the end of November last year, HKEX hosted 2,582 listed companies with a market capitalisation of approximately US$4.27 trillion, compared to IDX’s 828 listed companies with a market capitalisation of approximately US$613 billion.

Source: EY, Global IPO Trends 2022 for 2022 YTD data; Deloitte, Southeast Asia IPO Capital Market – 2021 full year report

Note: 2022 Dec (YTD) refers to the full calendar year and covers completed IPOs from 1 January 2022 to 5 December 2022, plus expected IPOs by 31 December 2022 (forecasted as of 5 December 2022).

Sources: EY analysis, Dealogic

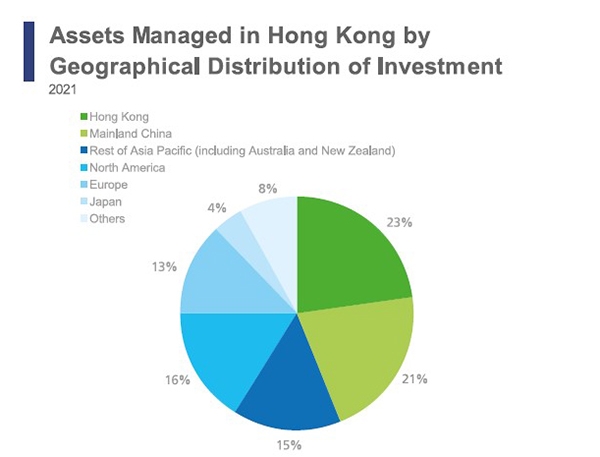

As an international financial centre, Hong Kong is well represented by a huge and diversified pool of both institutional and retail investors who invest in the Asia-Pacific region. For example, SFC’s annual Asset and Wealth Management Activities Survey 2021 shows that 15% of AUM (assets under management) in Hong Kong were invested in the Asia-Pacific region excluding Mainland China, Hong Kong and Japan (which mainly covers ASEAN, Australia and New Zealand). Companies listed on HKEx can take advantage of the connection between HKEx and international investors who are increasingly interested in investing in the ASEAN region, and gain better access to an immense pool of international funds for regional business expansion.

Source: SFC

Report compilers conducted in-depth interviews with senior executives of ASEAN and Hong Kong listed companies and other industry practitioners including lawyers, accountants and investment bankers, as well as academics to investigate Indonesian companies’ business needs

Interviewees highlighted sectors with good potential for Indonesian companies listing in Hong Kong, including mining and resources, consumer goods, advanced agriculture, real-estate investment trust (REIT) and IT/hi-tech.

Technology is an important driver of growth in the Indonesian economy. Indonesia’s Ministry of Finance predicts that technology adoption could add up to US$2.8 trillion to the Indonesian economy by 2040, or an additional 0.55 percentage points in gross domestic product growth annually over the coming two decades. Indonesia has an active start-up scene, with a 2021 Credit Suisse report estimating that 11 of the 35 unicorns in ASEAN are based in Indonesia.

Advanced agriculture has become a key area of development around the globe, partly because of greater emphasis on sustainability and food security. Indonesia has a rich agricultural heritage and a huge farming population that is connected to a reliable internet service. HKEx is set to allow pre-revenue tech companies to list, putting it in a good position to support the funding needs of Indonesian agricultural technology unicorns.

Mining-natural resources is a key sector for Indonesia, which is well known for its rich mineral reserves - nickel, gold, tin and copper in particular. Indonesia is home to more than one-fifth of global nickel reserves and was the ninth-largest gold producer in the world in 2021.

The consumer goods sector has grown robustly in Indonesia as the economy expanded and middle class grew. Indonesia’s per capita GDP increased from less than US$800 in 2000 to almost US$4,300 in 2021, while the World Bank estimated the country’s middle class in 2020 numbered at least 52 million.

The real estate market saw strong growth and confidence last year despite rising credit costs as demand for retail stores, commercial properties and logistics and data centres was robust, driven by solid economic growth and faster development in the logistics and telecommunication sector.

Related link HKMB HKTDC Research